Returning Capital to Shareholders . Nano is executing a balanced capital allocation approach that enables shareholder returns, investment in R&D and further growth through M&A. Nano has completed over $160 million in share repurchases over two programs to buy back its shares at compelling valuations to drive shareholder value since the first repurchase program was approved in August 2022.

Under Our Current Strategy

Nano Has Enacted Corporate Governance Enhancements

Nano has acted on feedback from shareholders and governance experts over the past year and instituted important enhancements to its corporate governance. These changes include:

Reducing the size of the Board from nine to eight directors, seven of whom are independent;

Separating the Company’s Chairman and CEO roles and appointing Dr. Nissan-Cohen as Chairman of the Board; and

Continuing efforts to refresh the Board, including the appointments of three new directors: Ambassador Georgette Mosbacher, Major General (Ret.) Eitan Ben-Eliahu and 4-Star General (Ret.) Michael Garrett.

Our accomplished Board consists of eight highly qualified individuals – seven of whom are independent – with diverse skills that align with and support our focus on growth, while taking our portfolio of proprietary manufacturing solutions to the next level.

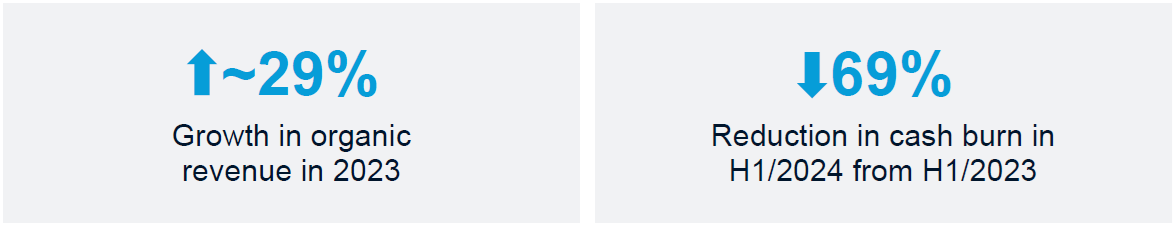

The two Nano directors targeted by Murchinson, our CEO Yoav Stern and 4-Star General (Ret.) Michael X. Garrett, are critical to the Board’s oversight of our strategy and continued success. During both their tenures, Nano has executed eight M&A transactions, including the recent agreements with Desktop Metal and Markforged, driven meaningful operational efficiencies, while delivering strong organic revenue growth, and made significant progress in innovation. With their deep expertise and institutional knowledge, we have the right Board in place to bolster our long-term strategy and deliver value for shareholders.

Murchinson Is, Again, Threatening to Derail Our Progress With Its Self-Interested Agenda Items

Last year, shareholders recognized that Murchinson brought NO plan for value creation, NO executable ideas, and NO director candidates with additive skills.

Despite shareholders’ clear rebuke last year, Murchinson is once again attempting to take control of Nano through a series of proposals that would paralyze Nano’s strategy, while facilitating Murchinson’s path to gain control of the Board and prevent us from maximizing long-term value for all shareholders. Murchinson is attempting to do this by removing two directors who are critical to our Board oversight in favor of two unqualified nominees, while also de-staggering the Board.

In addition, Murchinson has made a proposal, which Nano has rejected on legal grounds, seeking to prevent us from executing on any M&A transactions above $50 million, including our already signed agreements with Desktop Metal and Markforged. This absurd concept would effectively hold up Nano’s growth strategy to allow Murchinson time to take control of a de-staggered Board. Make no mistake, this approach is not an attempt to protect your interests: it is a blatant effort to freeze Nano in place as Murchinson seeks to gain control.

You have before you two proposals from Murchinson and the choice is clear:

Reject Murchinson’s Unqualified Director Nominees.

| ○ | Ofir Baharav is Nano’s prior Chairman of the Board. His career has been riddled with concerns about questionable ethics and failed businesses. Importantly, his oversight of Nano’s strategy led the Company to one of its most dire periods. He currently serves as the CEO of PowerBreezer, a fledgling ventilators manufacturer, which under Mr. Baharav’s leadership has failed to meet all its goals since 2016, including to complete an IPO. Prior to that, he was ousted from XJet, a company he founded, after conflicts with at least two prominent investors and the company’s co-founder. | |

| ○ | Robert Pons has ZERO direct 3D printing experience. | |

| ○ | These unqualified director candidates have NO additive skills, NO strategic plan, and NO independence from Murchinson. |

Reject De-Staggering the Board. A staggered Board ensures that only a portion of the directors are up for election at any given time, providing stability and continuity in leadership and allowing time for long-term strategic planning. Importantly, it also reduces risk of attempts to undervalue the Company in a takeover. Murchinson clearly recognizes that a staggered Board would make it harder for it to gain control – this proposal is a blatant attempt to make it easier to dismantle and liquidate Nano.

Murchinson Brings a History of Dubious, Self-Interested Behavior and NO Plan to Create Value for Nano’s Shareholders

As a reminder, Murchinson is a family hedge fund with a long track record of problematic actions and poor judgment – including stock manipulations, violations of law, and legal proceedings with regulatory authorities. This record extends to its founder, Marc Bistricer, who was required to pay the Securities and Exchange Commission (“SEC”) $8 million in August 2021 for rules violations and has subsequently been accused by the Ontario Security Commission of carrying out an abusive short-selling scheme. In addition, Murchinson’s co-conspirators Anson Funds and Anson Advisors were fined $2.25 million by the SEC for misleading disclosures in June 2024, just a few months after another October 2023 SEC fine.

Murchinson follows a simple playbook whereby the fund finds promising companies such as Nano, furtively acquires a large position and then seeks to dismantle the company and distribute its cash for Murchinson’s own benefit. The fund brings NO insight into the business, NO plan for value creation and NO executable ideas.

Murchinson’s own employees admit to these facts. Mr. Moshe Sarfaty, a senior analyst and employee of Murchinson, directly admitted to Murchinson’s lack of understanding of Nano’s business activities and valuation in his July 2023 court testimony:

“I don't analyze the activity, because I don't understand 3D printing…. we really have no idea what is good and what is not good to do here.”

With no insight into the business, it is clear Murchinson does not care about creating value for all of Nano’s shareholders – it only cares about itself. Murchinson is ultimately seeking to gain control of your Company without paying a premium. Allowing Murchinson to pursue its self-interested agenda through its proposals would deprive you of considerable upside as Nano continues to execute on its strategy.