Given these factors, as well as other variables that may affect Velodyne Lidar’s operating results, you should not rely on forward-looking statements, assume that past financial performance will be a reliable indicator of future performance, or use historical trends to anticipate results or trends in future periods. The forward-looking statements included in this press release relate only to events as of the date hereof. Velodyne Lidar undertakes no obligation to update or revise any forward-looking statement as a result of new information, future events or otherwise, except as otherwise required by law.

About Velodyne Lidar, Inc.

Velodyne Lidar (Nasdaq: VLDR, VLDRW) ushered in a new era of autonomous technology with the invention of real-time surround view lidar sensors. Velodyne, the global leader in lidar, is known for its broad portfolio of breakthrough lidar technologies. Velodyne’s revolutionary sensor and software solutions provide flexibility, quality and performance to meet the needs of a wide range of industries, including autonomous vehicles, advanced driver assistance systems (ADAS), robotics, unmanned aerial vehicles (UAV), smart cities and security. Through continuous innovation, Velodyne strives to transform lives and communities by advancing safer mobility for all. For more information, visit www.velodynelidar.com.

VELODYNE LIDAR, INC. AND SUBSIDIARIES |

|||||||

CONDENSED CONSOLIDATED BALANCE SHEETS |

|||||||

(In thousands) |

|||||||

(Unaudited) |

|||||||

|

June 30, |

|

December 31, |

||||

|

2022 |

|

2021 |

||||

Assets |

|

|

|

||||

Current assets: |

|

|

|

||||

Cash and cash equivalents |

$ |

77,024 |

|

|

$ |

24,064 |

|

Short-term investments |

|

152,185 |

|

|

|

270,357 |

|

Accounts receivable, net |

|

7,085 |

|

|

|

8,881 |

|

Inventories, net |

|

13,467 |

|

|

|

9,299 |

|

Prepaid and other current assets |

|

9,545 |

|

|

|

14,822 |

|

Total current assets |

|

259,306 |

|

|

|

327,423 |

|

Property, plant and equipment, net |

|

13,603 |

|

|

|

14,710 |

|

Operating lease right-of-use (ROU) assets |

|

16,557 |

|

|

|

16,891 |

|

| Goodwill |

|

1,189 |

|

|

|

1,189 |

|

| Intangible assets, net |

|

448 |

|

|

|

724 |

|

| Contract assets |

|

9,182 |

|

|

|

12,962 |

|

| Other assets |

|

1,557 |

|

|

|

1,522 |

|

| Total assets |

$ |

301,842 |

|

|

$ |

375,421 |

|

| Liabilities and Stockholders’ Equity |

|

|

|

||||

| Current liabilities: |

|

|

|

||||

| Accounts payable |

$ |

8,445 |

|

|

$ |

5,105 |

|

| Accrued expense and other current liabilities |

|

28,133 |

|

|

|

33,028 |

|

| Operating lease liabilities, current |

|

2,896 |

|

|

|

2,623 |

|

| Contract liabilities, current |

|

5,347 |

|

|

|

6,348 |

|

| Total current liabilities |

|

44,821 |

|

|

|

47,104 |

|

| Operating lease liabilities, non-current |

|

14,646 |

|

|

|

15,210 |

|

| Contract liabilities, non-current |

|

10,740 |

|

|

|

12,740 |

|

| Long-term tax liabilities |

|

449 |

|

|

|

443 |

|

| Other long-term liabilities |

|

988 |

|

|

|

661 |

|

| Total liabilities |

|

71,644 |

|

|

|

76,158 |

|

| Commitments and contingencies |

|

|

|

||||

| Stockholders’ equity: |

|

|

|

||||

| Preferred stock |

|

— |

|

|

|

— |

|

| Common stock |

|

22 |

|

|

|

20 |

|

| Additional paid-in capital |

|

851,132 |

|

|

|

825,988 |

|

| Accumulated other comprehensive loss |

|

(1,203 |

) |

|

|

(412 |

) |

| Accumulated deficit |

|

(619,753 |

) |

|

|

(526,333 |

) |

| Total stockholders’ equity |

|

230,198 |

|

|

|

299,263 |

|

| Total liabilities and stockholders’ equity |

$ |

301,842 |

|

|

$ |

375,421 |

|

| VELODYNE LIDAR, INC. AND SUBSIDIARIES |

|||||||||||||||||||

| CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS |

|||||||||||||||||||

| (In thousands, except share and per share data) |

|||||||||||||||||||

| (Unaudited) |

|||||||||||||||||||

|

|

Three Months Ended |

|

Six Months Ended |

||||||||||||||||

|

|

June 30, 2022 |

|

March 31, 2022 |

|

June 30, 2021 |

|

June 30, 2022 |

|

June 30, 2021 |

||||||||||

| Revenue: |

|

|

|

|

|

|

|

|

|

||||||||||

| Product |

$ |

9,652 |

|

|

$ |

4,362 |

|

|

$ |

11,970 |

|

|

$ |

14,014 |

|

|

$ |

22,563 |

|

| License and services |

|

1,855 |

|

|

|

1,818 |

|

|

|

1,626 |

|

|

|

3,673 |

|

|

|

8,759 |

|

| Total revenue |

|

11,507 |

|

|

|

6,180 |

|

|

|

13,596 |

|

|

|

17,687 |

|

|

|

31,322 |

|

| Cost of revenue: |

|

|

|

|

|

|

|

|

|

||||||||||

| Product |

|

18,347 |

|

|

|

15,196 |

|

|

|

19,210 |

|

|

|

33,543 |

|

|

|

34,839 |

|

| License and services |

|

257 |

|

|

|

267 |

|

|

|

170 |

|

|

|

524 |

|

|

|

349 |

|

| Total cost of revenue |

|

18,604 |

|

|

|

15,463 |

|

|

|

19,380 |

|

|

|

34,067 |

|

|

|

35,188 |

|

| Gross loss |

|

(7,097 |

) |

|

|

(9,283 |

) |

|

|

(5,784 |

) |

|

|

(16,380 |

) |

|

|

(3,866 |

) |

| Operating expenses: |

|

|

|

|

|

|

|

|

|

||||||||||

| Research and development |

|

18,757 |

|

|

|

21,297 |

|

|

|

17,009 |

|

|

|

40,054 |

|

|

|

35,387 |

|

| Sales and marketing |

|

5,340 |

|

|

|

6,005 |

|

|

|

47,176 |

|

|

|

11,345 |

|

|

|

54,251 |

|

| General and administrative |

|

13,430 |

|

|

|

12,317 |

|

|

|

19,133 |

|

|

|

25,747 |

|

|

|

36,169 |

|

| Total operating expenses |

|

37,527 |

|

|

|

39,619 |

|

|

|

83,318 |

|

|

|

77,146 |

|

|

|

125,807 |

|

| Operating loss |

|

(44,624 |

) |

|

|

(48,902 |

) |

|

|

(89,102 |

) |

|

|

(93,526 |

) |

|

|

(129,673 |

) |

| Interest income |

|

294 |

|

|

|

227 |

|

|

|

109 |

|

|

|

521 |

|

|

|

212 |

|

| Interest expense |

|

— |

|

|

|

(3 |

) |

|

|

(41 |

) |

|

|

(3 |

) |

|

|

(77 |

) |

| Other income (expense), net |

|

(110 |

) |

|

|

4 |

|

|

|

10,136 |

|

|

|

(106 |

) |

|

|

10,119 |

|

| Loss before income taxes |

|

(44,440 |

) |

|

|

(48,674 |

) |

|

|

(78,898 |

) |

|

|

(93,114 |

) |

|

|

(119,419 |

) |

| Provision for (benefit from) income taxes |

|

(141 |

) |

|

|

447 |

|

|

|

339 |

|

|

|

306 |

|

|

|

635 |

|

| Net loss |

$ |

(44,299 |

) |

|

$ |

(49,121 |

) |

|

$ |

(79,237 |

) |

|

$ |

(93,420 |

) |

|

$ |

(120,054 |

) |

| Net loss per share: |

|

|

|

|

|

|

|

|

|

||||||||||

| Basic and diluted |

$ |

(0.22 |

) |

|

$ |

(0.25 |

) |

|

$ |

(0.41 |

) |

|

$ |

(0.47 |

) |

|

$ |

(0.63 |

) |

| Weighted-average shares used in computing net loss per share: |

|

|

|

|

|

|

|

|

|

||||||||||

| Basic and diluted |

|

198,947,058 |

|

|

|

198,166,060 |

|

|

|

193,002,807 |

|

|

|

198,414,502 |

|

|

|

191,123,251 |

|

| VELODYNE LIDAR, INC. AND SUBSIDIARIES |

|||||||||||||||||||

| RECONCILIATION OF GAAP TO NON-GAAP FINANCIAL MEASURES |

|||||||||||||||||||

| (In thousands, except share and per share data) |

|||||||||||||||||||

| (Unaudited) |

|||||||||||||||||||

|

|

Three Months Ended |

|

Six Months Ended |

||||||||||||||||

|

|

June 30, 2022 |

|

March 31, 2022 |

|

June 30, 2021 |

|

June 30, 2022 |

|

June 30, 2021 |

||||||||||

| Gross loss on GAAP basis |

$ |

(7,097 |

) |

|

$ |

(9,283 |

) |

|

$ |

(5,784 |

) |

|

$ |

(16,380 |

) |

|

$ |

(3,866 |

) |

| Gross margin on GAAP basis |

|

(62 |

)% |

|

|

(150 |

)% |

|

|

(43 |

)% |

|

|

(93 |

)% |

|

|

(12 |

)% |

| Discontinued product line |

|

2,151 |

|

|

|

— |

|

|

|

— |

|

|

|

2,151 |

|

|

|

— |

|

| Stock-based compensation and related employer payroll taxes |

|

767 |

|

|

|

528 |

|

|

|

451 |

|

|

|

1,295 |

|

|

|

1,262 |

|

| Gross loss on non-GAAP basis |

$ |

(4,179 |

) |

|

$ |

(8,755 |

) |

|

$ |

(5,333 |

) |

|

$ |

(12,934 |

) |

|

$ |

(2,604 |

) |

| Gross margin on non-GAAP basis |

|

(36 |

)% |

|

|

(142 |

)% |

|

|

(39 |

)% |

|

|

(73 |

)% |

|

|

(8 |

)% |

|

|

|

|

|

|

|

|

|

|

|

||||||||||

| Operating expenses on GAAP basis |

$ |

37,527 |

|

|

$ |

39,619 |

|

|

$ |

83,318 |

|

|

$ |

77,146 |

|

|

$ |

125,807 |

|

| Stock-based compensation and related employer payroll taxes |

|

(5,600 |

) |

|

|

(4,474 |

) |

|

|

(53,624 |

) |

|

|

(10,074 |

) |

|

|

(66,969 |

) |

| Legal settlements |

|

— |

|

|

|

— |

|

|

|

(2,245 |

) |

|

|

— |

|

|

|

(1,245 |

) |

| Amortization of acquisition-related intangible assets |

|

(96 |

) |

|

|

(96 |

) |

|

|

(97 |

) |

|

|

(192 |

) |

|

|

(193 |

) |

| Operating expenses on non-GAAP basis |

$ |

31,831 |

|

|

$ |

35,049 |

|

|

$ |

27,352 |

|

|

$ |

66,880 |

|

|

$ |

57,400 |

|

|

|

|

|

|

|

|

|

|

|

|

||||||||||

| Operating loss on GAAP basis |

$ |

(44,624 |

) |

|

$ |

(48,902 |

) |

|

$ |

(89,102 |

) |

|

$ |

(93,526 |

) |

|

$ |

(129,673 |

) |

| Discontinued product line |

|

2,151 |

|

|

|

— |

|

|

|

— |

|

|

|

2,151 |

|

|

|

— |

|

| Stock-based compensation and related employer payroll taxes |

|

6,367 |

|

|

|

5,002 |

|

|

|

54,075 |

|

|

|

11,369 |

|

|

|

68,231 |

|

| Legal settlements |

|

— |

|

|

|

— |

|

|

|

795 |

|

|

|

— |

|

|

|

1,245 |

|

| Amortization of acquisition-related intangible assets |

|

96 |

|

|

|

96 |

|

|

|

97 |

|

|

|

192 |

|

|

|

193 |

|

| Operating loss on non-GAAP basis |

$ |

(36,010 |

) |

|

$ |

(43,804 |

) |

|

$ |

(34,135 |

) |

|

$ |

(79,814 |

) |

|

$ |

(60,004 |

) |

|

|

|

|

|

|

|

|

|

|

|

||||||||||

| Other income (expense), net on GAAP basis |

$ |

(110 |

) |

|

$ |

4 |

|

|

$ |

10,136 |

|

|

$ |

(106 |

) |

|

$ |

10,119 |

|

| Gain from forgiveness of PPP loan |

|

— |

|

|

|

— |

|

|

|

(10,124 |

) |

|

|

— |

|

|

|

(10,124 |

) |

| Other income (expense), net on non-GAAP basis |

$ |

(110 |

) |

|

$ |

4 |

|

|

$ |

12 |

|

|

$ |

(106 |

) |

|

$ |

(5 |

) |

|

|

|

|

|

|

|

|

|

|

|

||||||||||

| Net loss on GAAP basis |

$ |

(44,299 |

) |

|

$ |

(49,121 |

) |

|

$ |

(79,237 |

) |

|

$ |

(93,420 |

) |

|

$ |

(120,054 |

) |

| Discontinued product line |

|

2,151 |

|

|

|

— |

|

|

|

— |

|

|

|

2,151 |

|

|

|

— |

|

| Stock-based compensation and related employer payroll taxes |

|

6,367 |

|

|

|

5,002 |

|

|

|

54,075 |

|

|

|

11,369 |

|

|

|

68,231 |

|

| Legal settlements |

|

— |

|

|

|

— |

|

|

|

795 |

|

|

|

— |

|

|

|

1,245 |

|

| Amortization of acquisition-related intangible assets |

|

96 |

|

|

|

96 |

|

|

|

97 |

|

|

|

192 |

|

|

|

193 |

|

| Gain from forgiveness of PPP loan |

|

— |

|

|

|

— |

|

|

|

(10,124 |

) |

|

|

— |

|

|

|

(10,124 |

) |

| Net loss on non-GAAP basis |

$ |

(35,685 |

) |

|

$ |

(44,023 |

) |

|

$ |

(34,394 |

) |

|

$ |

(79,708 |

) |

|

$ |

(60,509 |

) |

|

|

|

|

|

|

|

|

|

|

|

||||||||||

| Net loss per share on GAAP basis |

|

|

|

|

|

|

|

|

|

||||||||||

| Basic and diluted |

$ |

(0.22 |

) |

|

$ |

(0.25 |

) |

|

$ |

(0.41 |

) |

|

$ |

(0.47 |

) |

|

$ |

(0.63 |

) |

| Weighted-average shares on GAAP basis |

|

|

|

|

|

|

|

|

|

||||||||||

| Basic and diluted |

|

198,947,058 |

|

|

|

198,166,060 |

|

|

|

193,002,807 |

|

|

|

198,414,502 |

|

|

|

191,123,251 |

|

| Net loss per share on non-GAAP basis |

|

|

|

|

|

|

|

|

|

||||||||||

| Basic and diluted |

$ |

(0.18 |

) |

|

$ |

(0.22 |

) |

|

$ |

(0.18 |

) |

|

$ |

(0.40 |

) |

|

$ |

(0.32 |

) |

| Weighted-average shares on non-GAAP basis |

|

|

|

|

|

|

|

|

|

||||||||||

| Basic and diluted |

|

198,947,058 |

|

|

|

198,166,060 |

|

|

|

193,002,807 |

|

|

|

198,414,502 |

|

|

|

191,123,251 |

|

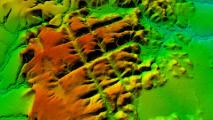

LiDAR technology confirms the existence of a "Lost City" in the Brazilian Amazon

LiDAR technology confirms the existence of a "Lost City" in the Brazilian Amazon