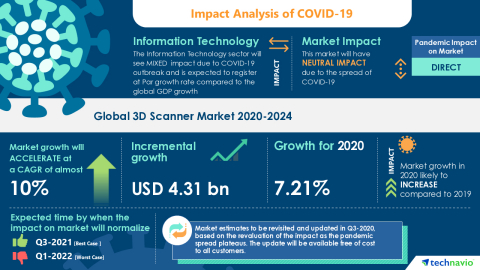

LONDON — (BUSINESS WIRE) — October 9, 2020 — Technavio has been monitoring the 3D scanner market and it is poised to grow by USD 4.31 billion during 2020-2024, progressing at a CAGR of almost 10% during the forecast period. The report offers an up-to-date analysis regarding the current market scenario, latest trends and drivers, and the overall market environment.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20201009005386/en/

Technavio has announced its latest market research report titled Global 3D Scanner Market 2020-2024 (Graphic: Business Wire)

Although the COVID-19 pandemic continues to transform the growth of various industries, the immediate impact of the outbreak is varied. While a few industries will register a drop in demand, numerous others will continue to remain unscathed and show promising growth opportunities. Technavio’s in-depth research has all your needs covered as our research reports include all foreseeable market scenarios, including pre- & post-COVID-19 analysis. Download a Free Sample Report on COVID-19 Impacts

Frequently Asked Questions-

- What are the major trends in the market?

- Increase in use of 3D scanning in entertainment is one of the major trends in the market.

- At what rate is the market projected to grow?

- Growing at a CAGR of almost 10%, the incremental growth of the market is anticipated to be USD 4.31 billion.

- Who are the top players in the market?

- 3D Systems Corp., AMETEK Inc., Artec Europe Sarl, Capture 3D Inc., Carl Zeiss Optotechnik GmbH, FARO Technologies Inc., Hexagon AB, Nikon Corp., Topcon Corp., and Trimble Inc. are some of the major market participants.

- What are the key market drivers and challenges?

- Rising adoption of portable handheld scanners is one of the major factors driving the market. However, the high cost of 3D scanners restraints market growth.

- How big is the APAC market?

- The APAC region will contribute 36% of market growth.

Buy 1 Technavio report and get the second for 50% off. Buy 2 Technavio reports and get the third for free.

View market snapshot before purchasing

The market is fragmented, and the degree of fragmentation will accelerate during the forecast period. 3D Systems Corp., AMETEK Inc., Artec Europe Sarl, Capture 3D Inc., Carl Zeiss Optotechnik GmbH, FARO Technologies Inc., Hexagon AB, Nikon Corp., Topcon Corp., and Trimble Inc. are some of the major market participants. The rising adoption of portable handheld scanners will offer immense growth opportunities. To make most of the opportunities, market vendors should focus more on the growth prospects in the fast-growing segments, while maintaining their positions in the slow-growing segments.

Buy 1 Technavio report and get the second for 50% off. Buy 2 Technavio reports and get the third for free.

View market snapshot before purchasing

Technavio's custom research reports offer detailed insights on the impact of COVID-19 at an industry level, a regional level, and subsequent supply chain operations. This customized report will also help clients keep up with new product launches in direct & indirect COVID-19 related markets, upcoming vaccines and pipeline analysis, and significant developments in vendor operations and government regulations.

3D Scanner Market 2020-2024: Segmentation

3D Scanner Market is segmented as below:

- Technology

- Laser Triangulation

- Structured Light

- End-user

- Industrial Manufacturing

- Healthcare

- Architecture and Engineering

- Aerospace and Defense

- Others

- Geographic Landscape

- North America

- APAC

- Europe

- South America

- MEA

- Product

- Short-range

- Medium-range

- Long-range

To learn more about the global trends impacting the future of market research, download a free sample: https://www.technavio.com/talk-to-us?report=IRTNTR43838

3D Scanner Market 2020-2024: Scope

Technavio presents a detailed picture of the market by the way of study, synthesis, and summation of data from multiple sources. The 3D scanner market report covers the following areas:

- 3D Scanner Market Size

- 3D Scanner Market Trends

- 3D Scanner Market Analysis

This study identifies an increase in use of 3D scanning in entertainment as one of the prime reasons driving the 3D scanner market growth during the next few years.

Technavio suggests three forecast scenarios (optimistic, probable, and pessimistic) considering the impact of COVID-19. Technavio’s in-depth research has direct and indirect COVID-19 impacted market research reports.

Register for a free trial today and gain instant access to 17,000+ market research reports. Technavio's SUBSCRIPTION platform

3D Scanner Market 2020-2024: Key Highlights

- CAGR of the market during the forecast period 2020-2024

- Detailed information on factors that will assist 3D scanner market growth during the next five years

- Estimation of the 3D scanner market size and its contribution to the parent market

- Predictions on upcoming trends and changes in consumer behavior

- The growth of the 3D scanner market

- Analysis of the market’s competitive landscape and detailed information on vendors

- Comprehensive details of factors that will challenge the growth of 3D scanner market vendors

Table of Contents:

Executive Summary

Market Landscape

- Market ecosystem

- Value chain analysis

Market Sizing

- Market definition

- Market segment analysis

- Market size 2019

- Market outlook: Forecast for 2019 - 2024

Five Forces Analysis

- Five Forces Summary

- Bargaining power of buyers

- Bargaining power of suppliers

- Threat of new entrants

- Threat of substitutes

- Threat of rivalry

- Market condition

Market Segmentation by Product

- Market segments

- Comparison by Product

- Short-range - Market size and forecast 2019-2024

- Medium-range - Market size and forecast 2019-2024

- Long-range - Market size and forecast 2019-2024

- Market opportunity by Product

Market Segmentation by Technology

- Market segments

- Comparison by Technology

- Laser triangulation - Market size and forecast 2019-2024

- Structured light - Market size and forecast 2019-2024

- Market opportunity by Technology

Market Segmentation by End-user

- Market segments

- Comparison by End-user

- Industrial manufacturing - Market size and forecast 2019-2024

- Healthcare - Market size and forecast 2019-2024

- Architecture and engineering - Market size and forecast 2019-2024

- Aerospace and defense - Market size and forecast 2019-2024

- Others - Market size and forecast 2019-2024

- Market opportunity by End-user