LAUSANNE, Switzerland & NEWARK, Calif. — (BUSINESS WIRE) — July 22, 2019 — Logitech International (SIX: LOGN) (Nasdaq: LOGI) today announced financial results for the first quarter of Fiscal Year 2020.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20190722005781/en/

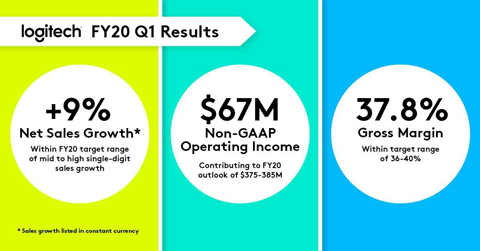

Logitech delivers a strong start to Fiscal Year 2020 with robust sales and profit growth. (Graphic: Business Wire)

- Q1 sales were $644 million, up 6 percent in US dollars and 9 percent in constant currency, compared to Q1 of the prior year.

- Q1 GAAP operating income grew 46 percent to $47 million, compared to $32 million in the same quarter a year ago. Q1 GAAP earnings per share (EPS) grew 17 percent to $0.27, compared to $0.23 in the same quarter a year ago.

- Q1 non-GAAP operating income grew 11 percent to $67 million, compared to $61 million in the same quarter a year ago. Q1 non-GAAP EPS grew 15 percent to $0.39, compared to $0.34 in the same quarter a year ago.

- Cash flow from operations was $37 million, compared to $12 million in the same period a year ago.

“We had a strong start to the year thanks to the consistent execution of our strategy,” said Bracken Darrell, Logitech president and chief executive officer. “Our portfolio of innovative products continues to deliver. We achieved double-digit growth across a number of categories, including Video Collaboration, and growth in all three regions. I’m excited about our business and the innovation ahead of us.”

Outlook

Logitech confirmed its Fiscal Year 2020 outlook of mid to high single-digit sales growth in constant currency and $375 million to $385 million in non-GAAP operating income.

CFO Search

Logitech today confirmed that Nate Olmstead is now the Company’s new chief financial officer, effective immediately. Nate joined Logitech in 2019 as vice president of business finance, with over 16 years of financial management experience, most recently as the vice president of finance for global operations at Hewlett Packard Enterprise.

“Nate has proven to be a good fit for us as a chief financial officer,” said Bracken Darrell, Logitech president and chief executive officer. “He has shown strong strategic insight, financial acumen, and practical operational experience. I look forward to building on our terrific partnership for many years to come.”

Prepared Remarks Available Online

Logitech has made its prepared written remarks for the financial results teleconference available online on the Logitech corporate website at http://ir.logitech.com.

Financial Results Teleconference and Webcast

Logitech will hold a financial results teleconference to discuss the results for Q1 FY 2020 on Tuesday, July 23, 2019 at 8:30 a.m. Eastern Daylight Time and 2:30 p.m. Central European Summer Time. A live webcast of the call will be available on the Logitech corporate website at http://ir.logitech.com.

Use of Non-GAAP Financial Information and Constant Currency

To facilitate comparisons to Logitech’s historical results, Logitech has included non-GAAP adjusted measures, which exclude share-based compensation expense, amortization of intangible assets, purchase accounting effect on inventory, acquisition-related costs, change in fair value of contingent consideration for business acquisition, restructuring charges (credits), loss (gain) on investments, non-GAAP income tax adjustment, and other items detailed under “Supplemental Financial Information” after the tables below. Logitech also presents percentage sales growth in constant currency to show performance unaffected by fluctuations in currency exchange rates. Percentage sales growth in constant currency is calculated by translating prior period sales in each local currency at the current period’s average exchange rate for that currency and comparing that to current period sales. Logitech believes this information, used together with the GAAP financial information, will help investors to evaluate its current period performance and trends in its business. With respect to the Company’s outlook for non-GAAP operating income, most of these excluded amounts pertain to events that have not yet occurred and are not currently possible to estimate with a reasonable degree of accuracy. Therefore, no reconciliation to the GAAP amounts has been provided for Fiscal Year 2020.

About Logitech

Logitech designs products that have an everyday place in people's lives, connecting them to the digital experiences they care about. More than 35 years ago, Logitech started connecting people through computers, and now it’s a multi-brand company designing products that bring people together through music, gaming, video and computing. Brands of Logitech include Logitech, Logitech G, ASTRO Gaming, Ultimate Ears, Jaybird and Blue Microphones. Founded in 1981, and headquartered in Lausanne, Switzerland, Logitech International is a Swiss public company listed on the SIX Swiss Exchange (LOGN) and on the Nasdaq Global Select Market (LOGI). Find Logitech at www.logitech.com, the company blog or @Logitech.

This press release contains forward-looking statements within the meaning of the U.S. federal securities laws, including, without limitation, statements regarding: our preliminary financial results for the three months ended June 30, 2019, innovation, secular trends, opportunities, and outlook for Fiscal Year 2020 operating income and sales growth. The forward-looking statements in this release involve risks and uncertainties that could cause Logitech’s actual results and events to differ materially from those anticipated in these forward-looking statements, including, without limitation: if our product offerings, marketing activities and investment prioritization decisions do not result in the sales, profitability or profitability growth we expect, or when we expect it; if we fail to innovate and develop new products in a timely and cost-effective manner for our new and existing product categories; if we do not successfully execute on our growth opportunities or our growth opportunities are more limited than we expect; the effect of pricing, product, marketing and other initiatives by our competitors, and our reaction to them, on our sales, gross margins and profitability; if our products and marketing strategies fail to separate our products from competitors’ products; if we do not fully realize our goals to lower our costs and improve our operating leverage; if there is a deterioration of business and economic conditions in one or more of our sales regions or product categories, or significant fluctuations in exchange rates; changes in trade policies and agreements and the imposition of tariffs that affect our products or operations and our ability to mitigate; risks associated with acquisitions. A detailed discussion of these and other risks and uncertainties that could cause actual results and events to differ materially from such forward-looking statements is included in Logitech’s periodic filings with the Securities and Exchange Commission, including our Annual Report on Form 10-K for the fiscal year ended March 31, 2019, available at www.sec.gov, under the caption Risk Factors and elsewhere. Logitech does not undertake any obligation to update any forward-looking statements to reflect new information or events or circumstances occurring after the date of this press release.

Note that unless noted otherwise, comparisons are year over year.

Logitech and other Logitech marks are trademarks or registered trademarks of Logitech Europe S.A and/or its affiliates in the U.S. and other countries. All other trademarks are the property of their respective owners. For more information about Logitech and its products, visit the company’s website at www.logitech.com.

|

LOGITECH INTERNATIONAL S.A. |

|

|

|

|

||||

|

PRELIMINARY RESULTS * |

|

|

|

|

||||

|

(In thousands, except per share amounts) - unaudited |

|

|

|

|

||||

|

|

|

|

|

|

||||

|

|

|

Three Months Ended |

||||||

|

|

|

June 30, |

||||||

|

GAAP CONDENSED CONSOLIDATED STATEMENTS OF OPERATIONS |

|

2019 |

|

2018 |

||||

|

|

|

|

|

|

||||

|

Net sales |

|

$ |

644,225 |

|

|

$ |

608,480 |

|

|

Cost of goods sold |

|

401,978 |

|

|

382,171 |

|

||

|

Amortization of intangible assets and purchase accounting effect on inventory |

|

3,271 |

|

|

2,372 |

|

||

|

Gross profit |

|

238,976 |

|

|

223,937 |

|

||

|

|

|

|

|

|

||||

|

Operating expenses: |

|

|

|

|

||||

|

Marketing and selling |

|

123,033 |

|

|

114,584 |

|

||

|

Research and development |

|

42,243 |

|

|

38,987 |

|

||

|

General and administrative |

|

22,159 |

|

|

25,473 |

|

||

|

Amortization of intangible assets and acquisition-related costs |

|

3,596 |

|

|

2,521 |

|

||

|

Restructuring charges, net |

|

478 |

|

|

9,921 |

|

||

|

Total operating expenses |

|

191,509 |

|

|

191,486 |

|

||

|

|

|

|

|

|

||||

|

Operating income |

|

47,467 |

|

|

32,451 |

|

||

|

Interest income |

|

2,553 |

|

|

2,369 |

|

||

|

Other income (expense), net |

|

1,861 |

|

|

(1,571 |

) |

||

|

Income before income taxes |

|

51,881 |

|

|

33,249 |

|

||

|

Provision for (benefit from) income taxes (A) |

|

6,536 |

|

|

(5,217 |

) |

||

|

Net income |

|

$ |

45,345 |

|

|

$ |

38,466 |

|

|

|

|

|

|

|

||||

|

Net income per share: |

|

|

|

|

||||

|

Basic |

|

$ |

0.27 |

|

|

$ |

0.23 |

|

|

Diluted |

|

$ |

0.27 |

|

|

$ |

0.23 |

|

|

|

|

|

|

|

||||

|

Weighted average shares used to compute net income per share: |

|

|

|

|

||||

|

Basic |

|

166,302 |

|

|

165,317 |

|

||

|

Diluted |

|

168,797 |

|

|

168,756 |

|

||

|

LOGITECH INTERNATIONAL S.A. |

|

|

|

|

||||

|

PRELIMINARY RESULTS * |

|

|

|

|

||||

|

(In thousands) - unaudited |

|

|

|

|

||||

|

|

|

|

|

|

||||

|

|

|

June 30, 2019 |

|

March 31, 2019 |

||||

|

CONDENSED CONSOLIDATED BALANCE SHEETS |

|

|

||||||

|

|

|

|

|

|

||||

|

Current assets: |

|

|

|

|

||||

|

Cash and cash equivalents |

|

$ |

596,956 |

|

|

$ |

604,516 |

|

|

Accounts receivable, net |

|

418,816 |

|

|

383,309 |

|

||

|

Inventories |

|

297,007 |

|

|

293,495 |

|

||

|

Other current assets |

|

68,927 |

|

|

69,116 |

|

||

|

Total current assets |

|

1,381,706 |

|

|

1,350,436 |

|

||

|

Non-current assets: |

|

|

|

|

||||

|

Property, plant and equipment, net |

|

76,713 |

|

|

78,552 |

|

||

|

Goodwill |

|

343,702 |

|

|

343,684 |

|

||

|

Other intangible assets, net |

|

112,132 |

|

|

118,999 |

|

||

|

Other assets (B) |

|

173,448 |

|

|

132,453 |

|

||

|

Total assets |

|

$ |

2,087,701 |

|

|

$ |

2,024,124 |

|

|

|

|

|

|

|

||||

|

Current liabilities: |

|

|

|

|

||||

|

Accounts payable |

|

$ |

338,748 |

|

|

$ |

283,922 |

|

|

Accrued and other current liabilities (B) |

|

394,675 |

|

|

433,897 |

|

||

|

Total current liabilities |

|

733,423 |

|

|

717,819 |

|

||

|

Non-current liabilities: |

|

|

|

|

||||

|

Income taxes payable |

|

36,133 |

|

|

36,384 |

|

||

|

Other non-current liabilities (B) |

|

120,111 |

|

|

93,582 |

|

||

|

Total liabilities |

|

889,667 |

|

|

847,785 |

|

||

|

|

|

|

|

|

||||

|

Shareholders’ equity: |

|

|

|

|

||||

|

Registered shares, CHF 0.25 par value: |

|

30,148 |

|

|

30,148 |

|

||

|

Issued shares — 173,106 at June 30 and March 31, 2019 |

|

|

|

|

||||

|

Additional shares that may be issued out of conditional capitals — 50,000 at June 30 and March 31, 2019 |

|

|

|

|

||||

|

Additional shares that may be issued out of authorized capital — 34,621 at June 30 and March 31, 2019 |

|

|

|

|

||||

|

Additional paid-in capital |

|

35,048 |

|

|

56,655 |

|

||

|

Shares in treasury, at cost — 6,642 at June 30, 2019 and 7,244 at March 31, 2019 |

|

(170,140 |

) |

|

(169,802 |

) |

||

|

Retained earnings |

|

1,410,381 |

|

|

1,365,036 |

|

||

|

Accumulated other comprehensive loss |

|

(107,403 |

) |

|

(105,698 |

) |

||

|

Total shareholders’ equity |

|

1,198,034 |

|

|

1,176,339 |

|

||

|

Total liabilities and shareholders’ equity |

|

$ |

2,087,701 |

|

|

$ |

2,024,124 |

|

|

LOGITECH INTERNATIONAL S.A. |

|

|

|

|

||||

|

PRELIMINARY RESULTS * |

|

|

|

|

||||

|

(In thousands) - unaudited |

|

|

|

|

||||

|

|

|

Three Months Ended |

||||||

|

|

|

June 30, |

||||||

|

CONDENSED CONSOLIDATED STATEMENTS OF CASH FLOWS |

|

2019 |

|

2018 |

||||

|

|

|

|

|

|

||||

|

Cash flows from operating activities: |

|

|

|

|

||||

|

Net income |

|

$ |

45,345 |

|

|

$ |

38,466 |

|

|

Adjustments to reconcile net income to net cash provided by operating activities: |

|

|

|

|

||||

|

Depreciation |

|

10,802 |

|

|

10,699 |

|

||

|

Amortization of intangible assets |

|

6,867 |

|

|

4,893 |

|

||

|

Loss (gain) on investments |

|

(211 |

) |

|

13 |

|

||

|

Share-based compensation expense |

|

12,218 |

|

|

13,259 |

|

||

|

Deferred income taxes |

|

(3,381 |

) |

|

(9,659 |

) |

||

|

Other |

|

(4 |

) |

|

124 |

|

||

|

Changes in assets and liabilities, net of acquisitions: |

|

|

|

|

||||

|

Accounts receivable, net |

|

(34,264 |

) |

|

(68,557 |

) |

||

|

Inventories |

|

(2,681 |

) |

|

(18,200 |

) |

||

|

Other assets |

|

(5,387 |

) |

|

(4,225 |

) |

||

|

Accounts payable |

|

55,592 |

|

|

51,188 |

|

||

|

Accrued and other liabilities |

|

(48,380 |

) |

|

(5,719 |

) |

||

|

Net cash provided by operating activities |

|

36,516 |

|

|

12,282 |

|

||

|

Cash flows from investing activities: |

|

|

|

|

||||

|

Purchases of property, plant and equipment |

|

(9,340 |

) |

|

(8,744 |

) |

||

|

Investment in privately held companies |

|

(170 |

) |

|

(225 |

) |

||

|

Acquisitions, net of cash acquired |

|

— |

|

|

(243 |

) |

||

|

Purchases of trading investments |

|

(1,155 |

) |

|

(2,500 |

) |

||

|

Proceeds from sales of trading investments |

|

1,196 |

|

|

2,867 |

|

||

|

Net cash used in investing activities |

|

(9,469 |

) |

|

(8,845 |

) |

||

|

Cash flows from financing activities: |

|

|

|

|

||||

|

Purchases of registered shares |

|

(15,127 |

) |

|

(9,982 |

) |

||

|

Proceeds from exercises of stock options and purchase rights |

|

393 |

|

|

1,104 |

|

||

|

Tax withholdings related to net share settlements of restricted stock units |

|

(19,370 |

) |

|

(25,081 |

) |

||

|

Net cash used in financing activities |

|

(34,104 |

) |

|

(33,959 |

) |

||

|

Effect of exchange rate changes on cash and cash equivalents |

|

(503 |

) |

|

(7,309 |

) |

||

|

Net decrease in cash and cash equivalents |

|

(7,560 |

) |

|

(37,831 |

) |

||

|

Cash and cash equivalents, beginning of the period |

|

604,516 |

|

|

641,947 |

|

||

|

Cash and cash equivalents, end of the period |

|

$ |

596,956 |

|

|

$ |

604,116 |

|

|

LOGITECH INTERNATIONAL S.A. |

|

|

|

|

|

|

|||||

|

PRELIMINARY RESULTS * |

|

|

|

|

|||||||

|

(In thousands) - unaudited |

|

|

|

|

|||||||

|

|

|

|

|

|

|

|

|||||

|

NET SALES |

|

Three Months Ended |

|||||||||

|

|

|

June 30, |

|||||||||

|

SUPPLEMENTAL FINANCIAL INFORMATION |

|

2019 |

|

2018 |

|

Change |

|||||

|

|

|

|

|

|

|

|

|||||

|

Net sales by product category: |

|

|

|

|

|

|

|||||

|

Pointing Devices |

|

$ |

121,983 |

|

|

$ |

127,790 |

|

|

(5 |

)% |

|

Keyboards & Combos |

|

128,679 |

|

|

128,222 |

|

|

— |

|

||

|

PC Webcams |

|

28,128 |

|

|

29,674 |

|

|

(5 |

) |

||

|

Tablet & Other Accessories |

|

38,339 |

|

|

32,436 |

|

|

18 |

|

||

|

Video Collaboration |

|

73,424 |

|

|

58,792 |

|

|

25 |

|

||

|

Mobile Speakers |

|

50,416 |

|

|

34,327 |

|

|

47 |

|

||

|

Audio & Wearables |

|

58,624 |

|

|

52,154 |

|

|

12 |

|

||

|

Gaming |

|

134,515 |

|

|

136,026 |

|

|

(1 |

) |

||

|

Smart Home |

|

9,864 |

|

|

9,011 |

|

|

9 |

|

||

|

Other (1) |

|

253 |

|

|

48 |

|

|

427 |

|

||

|

Total sales |

|

$ |

644,225 |

|

|

$ |

608,480 |

|

|

6 |

% |

|

(1) Other category includes products that we currently intend to phase out, or have already phased out, because they are no longer strategic to our business. |

|

LOGITECH INTERNATIONAL S.A. |

|

|

|

|

||||

|

PRELIMINARY RESULTS * |

|

|

|

|

||||

|

(In thousands, except per share amounts) - Unaudited |

|

|

|

|

||||

|

|

|

|

|

|

||||

|

GAAP TO NON-GAAP RECONCILIATION (C) |

|

Three Months Ended |

||||||

|

|

|

June 30, |

||||||

|

SUPPLEMENTAL FINANCIAL INFORMATION |

|

2019 |

|

2018 |

||||

|

|

|

|

|

|

||||

|

Gross profit - GAAP |

|

$ |

238,976 |

|

|

$ |

223,937 |

|

|

Share-based compensation expense |

|

1,158 |

|

|

1,130 |

|

||

|

Amortization of intangible assets and purchase accounting effect on inventory |

|

3,271 |

|

|

2,372 |

|

||

|

Gross profit - Non-GAAP |

|

$ |

243,405 |

|

|

$ |

227,439 |

|

|

|

|

|

|

|

||||

|

Gross margin - GAAP |

|

37.1 |

% |

|

36.8 |

% |

||

|

Gross margin - Non-GAAP |

|

37.8 |

% |

|

37.4 |

% |

||

|

|

|

|

|

|

||||

|

Operating expenses - GAAP |

|

$ |

191,509 |

|

|

$ |

191,486 |

|

|

Less: Share-based compensation expense |

|

11,060 |

|

|

12,129 |

|

||

|

Less: Amortization of intangible assets and acquisition-related costs |

|

3,596 |

|

|

2,521 |

|

||

|

Less: Restructuring charges, net |

|

478 |

|

|

9,921 |

|

||

|

Operating expenses - Non-GAAP |

|

$ |

176,375 |

|

|

$ |

166,915 |

|

|

|

|

|

|

|

||||

|

% of net sales - GAAP |

|

29.7 |

% |

|

31.5 |

% |

||

|

% of net sales - Non - GAAP |

|

27.4 |

% |

|

27.4 |

% |

||

|

|

|

|

|

|

||||

|

Operating income - GAAP |

|

$ |

47,467 |

|

|

$ |

32,451 |

|

|

Share-based compensation expense |

|

12,218 |

|

|

13,259 |

|

||

|

Amortization of intangible assets |

|

6,867 |

|

|

4,893 |

|

||

|

Restructuring charges, net |

|

478 |

|

|

9,921 |

|

||

|

Operating income - Non - GAAP |

|

$ |

67,030 |

|

|

$ |

60,524 |

|

|

|

|

|

|

|

||||

|

% of net sales - GAAP |

|

7.4 |

% |

|

5.3 |

% |

||

|

% of net sales - Non - GAAP |

|

10.4 |

% |

|

9.9 |

% |

||

|

|

|

|

|

|

||||

|

Net income - GAAP |

|

$ |

45,345 |

|

|

$ |

38,466 |

|

|

Share-based compensation expense |

|

12,218 |

|

|

13,259 |

|

||

|

Amortization of intangible assets |

|

6,867 |

|

|

4,893 |

|

||

|

Restructuring charges, net |

|

478 |

|

|

9,921 |

|

||

|

Loss (gain) on investments |

|

(211 |

) |

|

13 |

|

||

|

Non-GAAP income tax adjustment |

|

907 |

|

|

(9,109 |

) |

||

|

Net income - Non - GAAP |

|

$ |

65,604 |

|

|

$ |

57,443 |

|

|

|

|

|

|

|

||||

|

Net income per share: |

|

|

|

|

||||

|

Diluted - GAAP |

|

$ |

0.27 |

|

|

$ |

0.23 |

|

|

Diluted - Non - GAAP |

|

$ |

0.39 |

|

|

$ |

0.34 |

|

|

|

|

|

|

|

||||

|

Shares used to compute net income per share: |

|

|

|

|

||||

|

Diluted - GAAP and Non - GAAP |

|

168,797 |

|

|

168,756 |

|

||

|

LOGITECH INTERNATIONAL S.A. |

|

|

|

|

||||

|

PRELIMINARY RESULTS * |

|

|

|

|

||||

|

(In thousands) - unaudited |

|

|

|

|

||||

|

|

|

|

|

|

||||

|

SHARE-BASED COMPENSATION EXPENSE |

|

Three Months Ended |

||||||

|

|

|

June 30, |

||||||

|

SUPPLEMENTAL FINANCIAL INFORMATION |

|

2019 |

|

2018 |

||||

|

|

|

|

|

|

||||

|

Share-based Compensation Expense |

|

|

|

|

||||

|

Cost of goods sold |

|

$ |

1,158 |

|

|

$ |

1,130 |

|

|

Marketing and selling |

|

6,849 |

|

|

5,786 |

|

||

|

Research and development |

|

2,154 |

|

|

1,549 |

|

||

|

General and administrative |

|

2,057 |

|

|

4,794 |

|

||

|

Total share-based compensation expense |

|

12,218 |

|

|

13,259 |

|

||

|

Income tax benefit |

|

(6,800 |

) |

|

(9,529 |

) |

||

|

Total share-based compensation expense, net of income tax benefit |

|

$ |

5,418 |

|

|

$ |

3,730 |

|