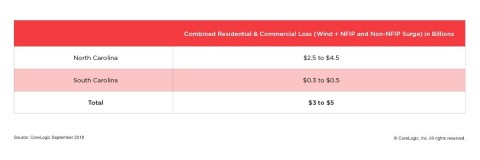

IRVINE, Calif. — (BUSINESS WIRE) — September 13, 2018 — CoreLogic® (NYSE: CLGX), a leading global property information, analytics and data-enabled solutions provider, today released data analysis showing insured property losses for both residential and now commercial properties from Hurricane Florence. This new analysis estimates between $3 billion and $5 billion in losses which has been expanded to include wind and storm surge. This does not include insured losses related to rainfall, riverine or other flooding since the full rainfall footprint is an element in factoring total losses. Hurricane Florence is expected to make landfall along the North Carolina and South Carolina coasts. In particular, 250,000 homes in North Carolina are projected to be affected by the hurricane.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20180913006142/en/

CoreLogic Combined Residential and Commercial Loss from Hurricane Florence (Graphic: Business Wire)

The following numbers have been refined based on the September 13, 8am PDT National Hurricane Center (NHC) track of the storm and the cone of uncertainty.

The table above shows the estimates for commercial and residential insured property losses by state in North Carolina and South Carolina. It does not include National Flood Insurance Program (NFIP) inland flood losses (only storm surge related NFIP flood losses) as it is too soon to tell what the potential rainfall, riverine, and other flooding will amount to in order to tabulate losses for that peril.

The number of residential properties indicated in the table above does not consider inland flooding. As Florence moves over land, it is expected to weaken, so some counties won’t experience the full impact of a Category 2 hurricane. This is represented in the table as zero values. Certain counties will experience both Category 1 and Category 2 impacts because the properties closer to the coast are likely to experience stronger winds relative to the more inland properties. In particular, it is expected that South Carolina will not exceed tropical storm force winds based on the projected track and is therefore not included in the table.

The table above shows the insured property loss estimates for past storms in the Carolinas if the events were to occur today with the current property exposure. These storms are not the same as Hurricane Florence; they have different track trajectories and landfalls. However, like Hurricane Florence, these storms were also Category 2 storms at landfall. These events are comparable to Florence in terms of their wind impacts. However, the storm surge losses from Florence are expected to be significantly greater. The table does not include a measure of inland flooding losses.

For major Gulf and Atlantic Coast hurricanes that impact the U.S. this year, CoreLogic is planning on providing pre-landfall data for the number and associated reconstruction cost value (RCV) of at-risk homes as well as a secondary set of pre-landfall data for estimated insured property losses for wind and storm surge. For post-landfall data, CoreLogic plans to issue insured and uninsured property losses for wind, storm surge and additionally flood. Visit the CoreLogic natural hazard risk information center, Hazard HQ™, at www.hazardhq.com to get access to the most up-to-date Hurricane Florence storm data and see reports from previous storms.

Methodology

The CoreLogic North American Hurricane Model includes advanced location risk and estimation through its robust stochastic event set, high-resolution hazard modeling, component-level vulnerability, and usage of PxPoint™, the parcel-level geocoding engine. The model provides the ability to calculate damage and loss contributions from storm surge, providing a transparent way of looking at loss as well as to obtain a better understanding of capital adequacy for the separate or combined perils of hurricane winds and coastal storm surge flooding. The model offers a complete view of the risk for all perils and sub-perils. The North Atlantic Hurricane Model is updated biennially and has been certified by the Florida Commission Hurricane Loss Projection Methodology (FCHLPM) since the inception of the process in 1997.

Source: CoreLogic The data provided are for use only by the primary recipient or the primary recipient's publication or broadcast. This data may not be resold, republished or licensed to any other source, including publications and sources owned by the primary recipient’s parent company without prior written permission from CoreLogic. Any CoreLogic data used for publication or broadcast, in whole or in part, must be sourced as coming from CoreLogic, a data and analytics company. For use with broadcast or web content, the citation must directly accompany first reference of the data. If the data is illustrated with maps, charts, graphs or other visual elements, the CoreLogic logo must be included on screen or website. For questions, analysis or interpretation of the data, contact Alyson Austin at newsmedia@corelogic.com or Caitlin New at corelogic@ink-co.com. Data provided may not be modified without the prior written permission of CoreLogic. Do not use the data in any unlawful manner. This data is compiled from public records, contributory databases and proprietary analytics, and its accuracy is dependent upon these sources.

About CoreLogic

CoreLogic (NYSE:

CLGX ) is a leading global property information,

analytics and data-enabled solutions provider. The company's combined

data from public, contributory and proprietary sources includes over 4.5

billion records spanning more than 50 years, providing detailed coverage

of property, mortgages and other encumbrances, consumer credit, tenancy,

location, hazard risk and related performance information. The markets

CoreLogic serves include real estate and mortgage finance, insurance,

capital markets, and the public sector. CoreLogic delivers value to

clients through unique data, analytics, workflow technology, advisory

and managed services. Clients rely on CoreLogic to help identify and

manage growth opportunities, improve performance and mitigate risk.

Headquartered in Irvine, Calif., CoreLogic operates in North America,

Western Europe and Asia Pacific. For more information, please visit

www.corelogic.com .