Secures account-to-account transactions by removing sensitive information from the transaction process

SUNNYVALE, Calif. — (BUSINESS WIRE) — May 9, 2018 — Rambus Inc. (NASDAQ: RMBS) today announced the launch of its Payment Account Tokenization solution to secure account-based transactions, such as automated clearing house (ACH) and real-time payments. The solution will enable central banks and clearing houses to replace sensitive account numbers with unique tokens and reduce the impact of fraud for transactions including direct credit, direct debit and person-to-person (P2P) payments.

This press release features multimedia. View the full release here: https://www.businesswire.com/news/home/20180509005399/en/

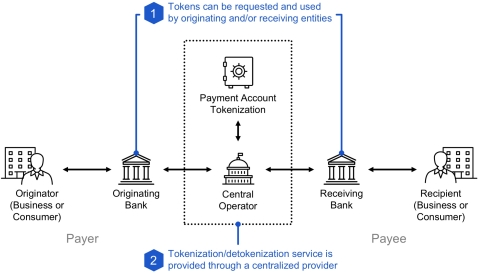

Rambus Payment Account Tokenization: How it Works (Graphic: Business Wire)

Reduce account fraud through tokenization

Payment Account Tokenization secures card payments by replacing the valuable account credentials with a cryptographic token. This process significantly reduces the risk and impact of account-based fraud as the foundation of a safe and secure instant payments framework. When implemented by a centralized body, like a central bank, Payment Account Tokenization reduces fraud and enables key use cases like P2P, direct credit, and push payments in real-time.

“Tokenization has already been proven successful in securing mobile payments worldwide. Our Payment Account Tokenization does the same for real-time payments, enabling account-based transactions to be processed faster and safer than ever before,” said Bret Sewell, SVP and general manager of the Rambus Security Division.

451 Research principal analyst, Jordan McKee notes, “Digital has paved the way for fast and easy payment experiences, prompting a rise in account-based transactions. Fraudsters have made note of this trend and are increasing their focus on account credentials given their growing disbursement across many locations, including e-commerce websites, mobile and P2P wallets, invoices and payroll. To protect customers and thwart fraudulent attacks, businesses must implement security tactics that serve to eliminate the use of sensitive credentials in the transaction flow.”

Managing account data, faster and safer

The introduction of real-time payments increases risk for financial institutions, as they now have seconds instead of days to identify fraudulent transactions. By removing account numbers from the transaction process completely, tokenization can significantly reduce the risk and impact of account-based fraud and create secure real-time payments frameworks.

Key features of Rambus Payment Account Tokenization

The Payment Account Tokenization solution consists of a number of primary features, including:

- Account-based tokenization eliminates the need to store and transmit sensitive account information, alleviating the risk of stolen credentials being used to commit transactional fraud. The system integrates with existing infrastructure and tokens route normally through the payment network.

- Life cycle management enables banks to link, suspend, (re)activate or unlink tokenized bank account numbers.

- Domain controls limit token usage to a specific channel, merchant or spending limit by applying a set of parameters. Any use of the intercepted token outside of its set parameters would immediately flag as fraudulent and render the token useless.

- Cryptogram protection generates application cryptograms prior to a payment and validates them during a transaction. A cryptogram is a fingerprint of the transaction, holding elements of the originator, recipient, financial institution and the transaction.

- A token vault is a secured repository, or database, that establishes and maintains the payment token to Sending/Receiving Account number mapping. The token vault is the only area in which the token can be mapped back to the consumer’s original card details. All token vaults comply with Payment Card Industry (PCI) specifications.

For more information on the Rambus Payment Account Tokenization solution, visit rambus.com/security/payments/payment-account-tokenization/.

Follow Rambus:

Company website:

rambus.com

Rambus

blog:

rambus.com/blog

Twitter:

@rambusinc

LinkedIn:

www.linkedin.com/company/rambus

Facebook:

www.facebook.com/RambusInc

About Rambus Security Division

Rambus Security is dedicated to providing a secure foundation for a

connected world. Our innovative solutions span areas including tamper

resistance, network security, mobile payment, smart ticketing

and trusted transaction services. Rambus foundational technologies

protect nearly nine billion licensed products annually, providing secure

access to data and creating an economy of digital trust between our

customers and their customer base. Additional information is available

at

rambus.com/security .